- Sheridan Technical High

- Free Application for Federal Student Aid (FAFSA®) form

Broward Advisor for Continuing Education (BRACE) News

Page Navigation

- Advisor, Mrs. DiAlberto

- College / University Information

- College Application Fees

- College Bound Students with Disabilities

- College Essay Strategies

- College Interview Process

- College Prep Events 2023-24

- Considering Medical School

- Considering the U.S. Military

- Contest Opportunities

- Exams; ACT / AP / ASVAB / PSAT / SAT

- Fee Waiver

- Free SAT/ACT Resources

- Financial Aid Information

- Free Application for Federal Student Aid (FAFSA®) form

- Internships

- Jobs with Tuition Reimbursement

- Scholarship Opportunities

- Summer Programs

- Top Tips from College Counselors

- Undocumented Student Resources

- Volunteer Opportunities

Free Application for Federal Student Aid (FAFSA®) form

-

Here are three things you should know about FAFSA and its financial aid opportunities:

- You may qualify for aid from your state and the federal government. Be sure you apply/renew on time to meet your state’s priority deadline.

- Applying/renewing your FAFSA online is the recommended method. Submitting this way allows you to use tools that will make the process quicker.

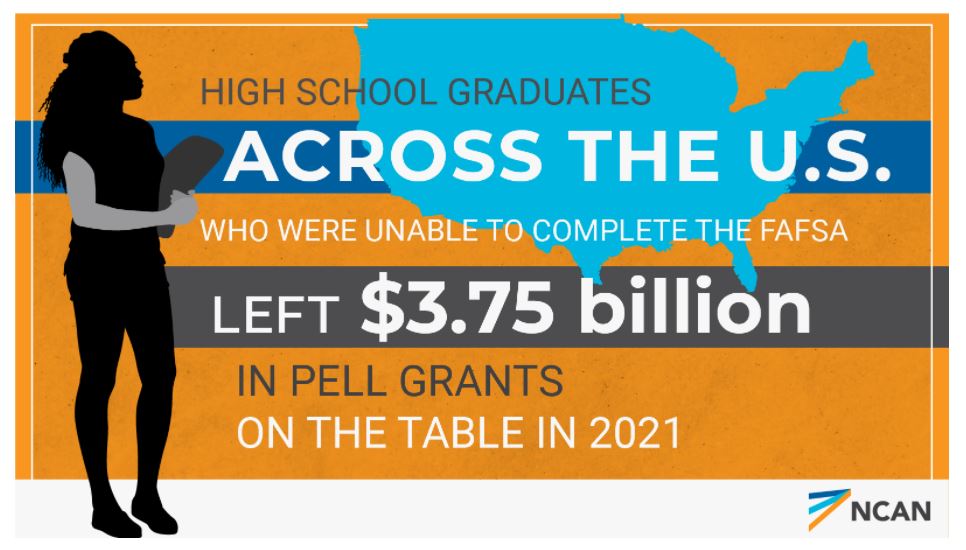

- The biggest FAFSA mistake is not completing or renewing the form at all.

Complete your FAFSA. Try to submit the FAFSA as early as possible to maximize your chances for college scholarships.

- You may qualify for aid from your state and the federal government. Be sure you apply/renew on time to meet your state’s priority deadline.

Student Aid Index

FAFSA Beta Test District - Important Dates and Family Support

Content Accordion

-

Federal Assistance Student Financial Aid (FASFA) Assistance

Why Invest In Increasing FASFA Completion?

After the FAFSA: What to Do Once You’ve Submitted Yours

The FAFSA on the Web allows families to transfer information provided on federal tax returns from the Internal Revenue Service (IRS) database to FAFSA on the Web. If you file your tax returns electronically, the tax data will be available for transfer to the FAFSA after three weeks. If you file paper tax returns, the tax data will be available for transfer after eight to ten weeks. If you completed your FAFSA before the IRS tax information was available for transfer, you can later transfer the IRS tax data as a FAFSA correction. Transferring tax information from the IRS to your FAFSA will cut down the amount of time the college needs to verify the information supplied on your FAFSA.

One of the most common errors on the FAFSA is for students to leave the student or parental asset fields blank. If there is no monetary value to report for assets, use a -0- rather than leaving the item blank.

If your parents are divorced, you will only have to provide information about the parent you lived with the most in the last year. If you lived with both parents for an equal amount of time in the last year, provide information about the parent who provided the most financial support to you. If that parent has remarried, you will need to report your parents' marital status as 'married' on the FAFSA and provide income and asset information for your stepparent.

If your family has unusual circumstances (such as divorce, death of a parent, loss of employment, loss of income or benefits, homelessness, unusually high medical expenses, active military service, natural disaster, foster care placement, etc.) that might affect your need for student financial aid, please be sure to consult with the financial aid office at the college you plan to attend. The financial aid director may be able to use professional judgment to adjust your financial aid eligibility.

Sign the FAFSA and have at least one parent whose information is provided on the form signing the FAFSA. You and your parents can apply for PIN numbers while completing the FAFSA on the Web, so you can sign the form electronically. Missing signatures cause delays in processing. (Note: There are special exceptions for parents unable to sign due to active military duty or natural disaster. Contact your college for further information.)

-

How To Read Your Student Aid Report (SAR)

You’ve submitted your FAFSA and you’ll soon get your SAR. Understand the report 100% by learning these financial aid report terms.

-

Scholarship Opportunity

Scholarships for FAFSA Completion

By confirming completion of the FAFSA, your students can qualify for drawings for $500 College Board Opportunity Scholarships. Here's how students qualify:- They sign up for CollegeBoard Opportunity Scholarships if they haven't yet joined.

- They fill out the FAFSA.

- Once they've submitted the FAFSA, they visit the My Action Plan page and confirm their submission.

If they are legally ineligible to complete the FAFSA, they can still qualify for this scholarship on their My Action Plan page.

Winners are selected monthly and are notified via the email in their College Board accounts. For questions about Opportunity Scholarships, email opportunityscholarships@collegeboard.org or call 844-298-3554.

Please do not forget to check our Scholarships Opportunities page.